The US cannabis industry is growing at an unprecedented rate and is projected to reach $146.4 billion by 2025. While this incredible success has been a great boon for the businesses serving the marketplace and for the U.S. economy overall, it has also brought with it a plethora of new challenges to overcome.

As the user base and profits of legal cannabis businesses continue to soar and as the industry becomes more regulated, it will invariably become increasingly more difficult for businesses to avoid risk exposure.

Staying in compliance to maintain your license to operate, mitigating claims from customers who use your products, and the potential financial risk of theft or natural perils are just a handful of issues cannabis businesses face.

All of these various risks can be financially crippling if your company is not properly protected when something goes wrong. Given that the legal cannabis industry faces a unique set of challenges and risks, cannabis businesses must create tailored risk management plans for themselves. This means understanding the specific insurance needs of your company.

A problem that legal cannabis pioneers are facing is the reluctance of traditional insurers to enter the marketplace and offer effective policies and tailored cannabis insurance programs. While this is slowly changing with the industry’s continued growth, cannabis insurance options remain limited.

Types of cannabis businesses

To help cannabis entrepreneurs determine what type of insurance they will need, it is crucial to understand what challenges various types of cannabis businesses face and how they can address them.

Dispensaries

Having robust coverage that can help you withstand the evolving legal climate, regulation changes, and general business risks is crucial to running a successful dispensary operation. In addition to basic coverage such as general liability insurance and workers comp, several other insurance policies can help protect your business from loss.

A property insurance policy will protect your business’s commercial property, including inventory, from the likes of fire, theft, and natural disasters. The right product liability coverage is critical for dispensaries and is often something that will be paired with a strong commercial general liability policy. If a product results in harm, illness, or unwanted side effects, the customer may hold you liable.

The point of sale is typically the first point of litigation, even if you were not at fault for the incident. Utilizing risk transfer tools such as requesting an additional insured endorsement from your partners is critical in the cannabis supply chain. Depending on the state you are operating in, seed-to-sale tracking technology will be required for your dispensary to operate.

Running a POS, inventory management, customer loyalty, or delivery service through technology is necessary to keeping up with demand and staying in compliance.

The following are suggested coverages for dispensaries:

- General Liability

- Product Liability

- Commercial Property

- Workers Compensation

- Business Income Coverage

- Cyber Liability

- Technology Errors & Omissions

Cultivators

Cultivators face a wide variety of risks to their operations, including fire, equipment breakdown, theft, vandalism, etc. Cannabis and hemp cultivation requires a tremendous investment in infrastructure. This includes equipment, lighting, seeds, security, and the crop growing at various stages of value, all of which can be points of vulnerability.

Fortunately, the right cannabis insurance program can protect your investment. Crop and property insurance are two of the most important insurance solutions for cultivators.

When grows are in controlled environments such as greenhouses or warehouses, crop insurance is more readily available. However, with the boom in hemp cultivators and the Farm Bill, outdoor crops are becoming easier to insure.

An inland marine or cargo policy would be a good addition to protect inventory in transit as businesses interact with wholesalers and dispensaries.

Suggested coverages for cultivators:

- General Liability

- Product Liability

- Commercial Property

- Workers Compensation

- Business Income Coverage

- Crop Coverage

- Commercial Auto

- Cargo / Inland Marine

Manufacturers

Cannabis and hemp manufacturers face significant regulatory requirements around licenses based on the inherent risks that are byproducts of the license-type.

Processing cannabis flower often can change the value of the product and mistakes can lead to significant losses if the entire plant is not utilized to its full potential. Additionally, manufacturing plants and equipment are expensive investments and should be protected by a good commercial property policy.

Depending on the equipment that a business uses, they can specifically list valuable pieces on the equipment policy for their full retail value. Equipment breakdown language can be added to further strengthen the value of the policy. A product liability policy can protect you in the case of a customer getting sick and will typically be required to sell products wholesale to dispensaries.

Suggested coverages for manufacturers:

- General Liability

- Product Liability

- Commercial Property

- Workers Compensation

- Business Income Coverage

- Cargo / Inland Marine

Landlords

Landlords in the cannabis industry face a unique set of risks and challenges even when compared to colleagues in the real estate industry. Many insurance carriers may refuse to cover claims from landlords who rent to cannabis businesses if this is not discussed upfront with the annual insurance renewal.

This is why working with a broker who has a dedicated cannabis practice can help you avoid unpaid claims for fire, vandalism, and other damages. Being as transparent as possible with your broker on who you are renting to can drastically change your experience and ability to recoup claims.

When establishing a growing real estate portfolio of cannabis businesses, there are ways to consolidate coverage with common ownership and assets in the same state.

Suggested coverages for landlords:

- General Liability

- Commercial Property

- Loss of Income

- Business Income Coverage

Testing laboratories

Testing labs are a key component for ensuring the health and safety of the cannabis market. However, evolving state and federal regulations create an assortment of potential lawsuits that the right cannabis insurance program can help you navigate, insuring you against potential errors or mistakes made in your operations.

Professional liability, also known as “errors & omissions”, is key for laboratories reporting to the state on data points that impact public safety. Property coverage is critical with the amount of equipment required to operate a high-volume cannabis lab.

Suggested coverages for testing labs:

- General Liability

- Commercial Property

- Product Liability

- Errors & Omissions

- Business Income Coverage

Delivery businesses

Whether you are a delivery-only dispensary or strictly a distribution company in this area, you can face a complicated set of risks. An employee’s personal auto insurance will not provide coverage in the event of an accident or robbery, as this policy usually excludes business use.

That means that your business can be held liable for damage to vehicles, injuries, and medical bills. Leveraging a “hired owned & non-owned” policy can improve your risk management program. Additionally, leveraging a cargo policy for your products once they leave your premises is a safe practice.

If a license holder is establishing a fleet of cars, commercial auto insurance coverage is required. The more vehicles your business owns, rents, and operates, the more your auto insurance will cost.

Suggested coverages for delivery businesses:

- Commercial Auto

- Hired Owned & Non-Owned Auto

- General Liability

- Business Income Coverage

- Product Liability

- Commercial Property

- Cargo / Inland Marine

- Workers Compensation

Medical cannabis physicians

Most insurance providers refuse to provide coverage for physicians that offer non-FDA medications. It is important to find insurance coverage that will protect medical cannabis physicians from malpractice and professional negligence lawsuits.

Suggested coverages for physicians:

- General Liability

- Errors & Omissions

Hydroponic shops

Hydroponic shops that work with cannabis businesses have access to a variety of coverages to ensure that they are protected from claims or damages. Commercial property coverage will protect your shop from the perils of fire, theft, and vandalism, for example.

Additionally, product liability will protect you from claims that could arise from the equipment you sell malfunctioning and causing losses to your customers.

Suggested coverages for hydroponic shops:

- General Liability

- Product Liability

- Commercial Property

- Business Income Coverage

- Cargo / Inland Marine

Recommended cannabis insurance companies

There are several options to choose from in regards to cannabis insurance. Depending on your location you may want to go with a local company for your needs. However, the list of companies below will service certain 420 businesses no matter where they are based. The google ratings of these companies suggest that these are the best cannabis insurance providers available.

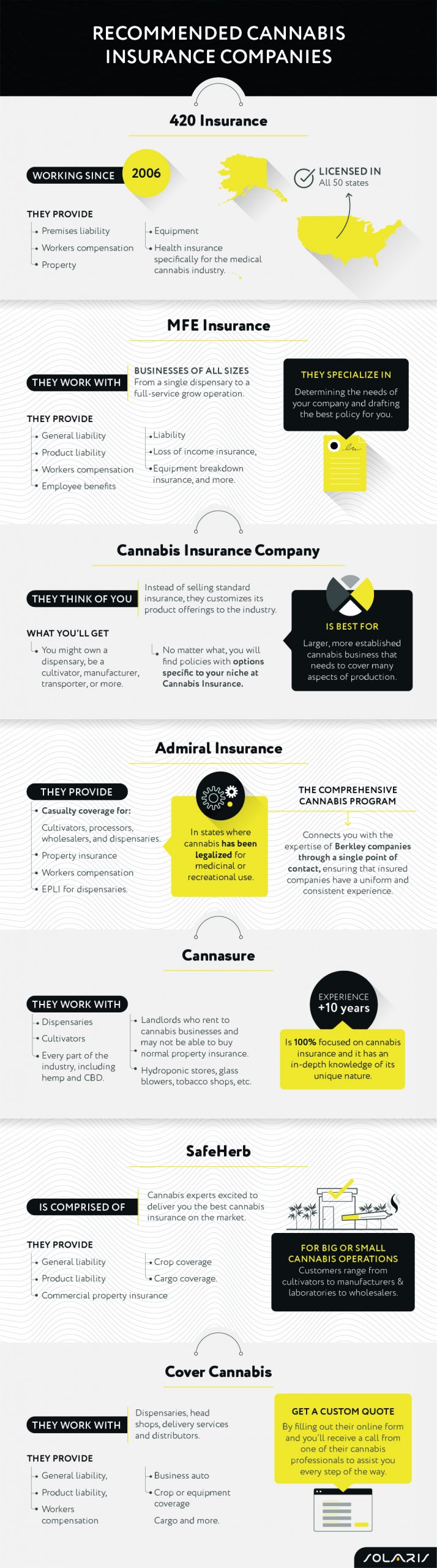

420 Insurance

420 Insurance has been protecting the cannabis sector since 2006. They provide premises liability, workers compensation, property and equipment, and even health insurance specifically for the medical cannabis industry. Representing over 100 insurance companies and being licensed in all 50 states allows them the ability to be your “one-stop insurance shop”.

MFE Insurance

MFE Insurance offers a wide range of cannabis insurance coverages. The company serves businesses of all sizes, from a single dispensary to a full-service grow operation. Coverage options include general liability and product liability, workers compensation and employee benefits, liability, loss of income insurance, equipment breakdown insurance, and more.

MFE’s team of Cannabis Insurance brokers specializes in determining the needs of your company and drafting the best policy for you.

Cannabis Insurance Company

Some of the cannabis insurance providers in the market sell standard business insurance policies to cannabis businesses. But Cannabis Insurance Company customizes its product offerings to the industry.

You might own a dispensary, be a cultivator, manufacturer, transporter, or more. No matter what, you will find policies with options specific to your niche at Cannabis Insurance. For example, a cultivator’s policy could protect your crops against lighting, fire, explosion, hail and smoke, and water damage. Cannabis Insurance Company is a great pick for a larger, more established cannabis business that needs to cover many aspects of production.

Admiral Insurance

Admiral Insurance Group offers casualty coverage for cultivators, processors, wholesalers, and dispensaries in states where cannabis has been legalized for medicinal or recreational use. They now also offer property insurance, workers compensation, and EPLI for dispensaries.

Recognizing the complex requirements of the ever-changing cannabis industry, Admiral crafted coverages that specifically meet the needs of cannabis businesses. The Comprehensive Cannabis Program connects you with the expertise of Berkley companies through a single point of contact, ensuring that insured companies have a uniform and consistent experience.

Cannasure

Cannasure’s 10 years of experience conveys the image of a focused, professional company. Launched to serve the cannabis industry’s insurance needs, Cannasure has an in-depth knowledge of its unique nature.

Unlike other insurance agencies or brokerages which tack cannabis insurance onto existing product offerings as an afterthought, Cannasure is 100 percent focused on cannabis insurance. Cannasure does not just sell policies to dispensaries and cultivators; it covers every part of the industry, including hemp and CBD.

Landlords who rent to cannabis businesses and may not be able to buy normal property insurance can get coverage through Cannasure. They also serve businesses related to the cannabis industry and sell policies to hydroponic stores, glass blowers, tobacco shops, and more.

SafeHerb

SafeHerb is comprised of cannabis experts excited to deliver you the best cannabis insurance on the market. They offer general liability, product liability, commercial property insurance, crop coverage, and even cargo coverage. SafeHerb customers range from cultivators to manufacturers and laboratories to wholesalers. Big or small cannabis operations are welcome to apply for coverage.

Cover Cannabis

Cover Cannabis is all about customizing your coverage. You can choose from several policies like general liability, product liability, workers compensation, business auto, crop or equipment coverage, and cargo plus more. Whether you want to insure your dispensary, head shop, delivery service, or distributor you can look to Cover Cannabis to protect your company.

Getting a custom quote is easy, all you need to do is fill out their quick and easy online form and you will receive a call from one of their cannabis professionals that will assist you every step of the way.